Former Governor: The Legislature Should Reject Any Attempt to Create a Different Tax Rate for So-Called ‘Skill Game’ Devices

Twenty years ago this week, I was in my second year as Governor. My team and I were in the midst of negotiating the State Budget for 2004-2005. A major part of that budget involved passage of the Gaming Act, which brought casino gaming — slot machines to be exact — to the Commonwealth. Gaming industry representatives bombarded me with messages and meeting requests. They wanted to convince me that the slot machine tax rate that I proposed — 52 percent, the highest in the country — was too high and that casinos could not successfully operate with taxes at that level. But I persisted. Something told me that it could work. And I knew that we could put the tax revenue that would be generated to good use statewide.

I am proud to say that my team and I were right. Despite the naysayers, today, we have a vibrant legal gaming industry in Pennsylvania that includes 17 casinos. The industry provides over 15,000 good paying jobs, with benefits and opportunities for career advancement. And remarkably, today, Pennsylvania’s legal gaming industry reliably provides the Commonwealth with more gaming tax revenue than any other state in the nation, including Nevada and New Jersey. In Fiscal Year 2022-2023 alone (the last full year on record), Pennsylvania’s gaming tax revenue totaled $2.36 billion.

From a tax revenue perspective, the legal gaming industry is more successful than I could have ever imagined. And these gaming taxes continue to be critically important to millions of Pennsylvanians — in every county — including those in counties that do not host a casino. For example, these revenues are used to lower school property taxes so that seniors and others living on fixed incomes can afford to stay in their homes. The taxes boost the agricultural community by supporting horse and harness racing. They pay for economic development projects across the Commonwealth. And these taxes provide “local share” funds to a multitude of counties and municipalities that are used to support public safety projects, volunteer fire companies, community groups, and non-profits.

The secret to maintaining Pennsylvania’s gaming tax juggernaut over the last 20 years has been the General Assembly’s disciplined and consistent approach with respect to setting tax rates. All currently authorized forms of slot machine style devices in the Commonwealth are taxed at the same 52 percent rate, be they slot machines at brick-and-mortar casinos, virtual slot machines online, or video gaming terminals (VGTs) in truck stops. This should not be a surprise. Pennsylvania’s Constitution requires that taxes be imposed in a “uniform” manner. Specifically, taxes must be the same for the same class of property.

Given all this, I am alarmed to hear that several current members of the General Assembly are proposing a disastrous tax give away that would benefit deep pocketed, out-of-state gaming interests who have been flooding Pennsylvania with political campaign contributions. These interests operate another type of slot machine-style device that is self-servingly called a “skill game,” even though the Commonwealth Court found that skill games fit within the definition of a slot machine under the Gaming Act. Importantly, rather than stick with the time-tested 52 percent tax rate that has served Pennsylvania well for nearly two decades, these legislators want to kill our Golden Goose and cut these out-of-state interests a sweetheart deal that would tax their machines somewhere between a laughable 16 percent, or a clearly non-uniform 34 percent. This is the definition of fiscal irresponsibility. Our legal gaming industry has already proven that all forms of slot machine-style gaming in the Commonwealth — including the type most similar to skill games, specifically VGTs — can operate successfully at the 52 percent rate.

It appears to me that the legislators who support the significantly reduced tax rate for skill games are misinformed. They apparently do not understand that the significant difference between a 52 percent tax rate and one ranging between 16 percent and 34 percent will cost Pennsylvanians millions of dollars a year in corporate tax revenue. As discussed above, gaming has provided a significant financial benefit to all Pennsylvanians. It has done so because, until now, legislators have been steadfast in holding the line that similar forms of gaming in the Commonwealth are taxed at the exact same rate. By following this approach, the Commonwealth has been able to ensure that the best interests of average Pennsylvanians are protected and that no one gets a sweetheart deal.

_____________

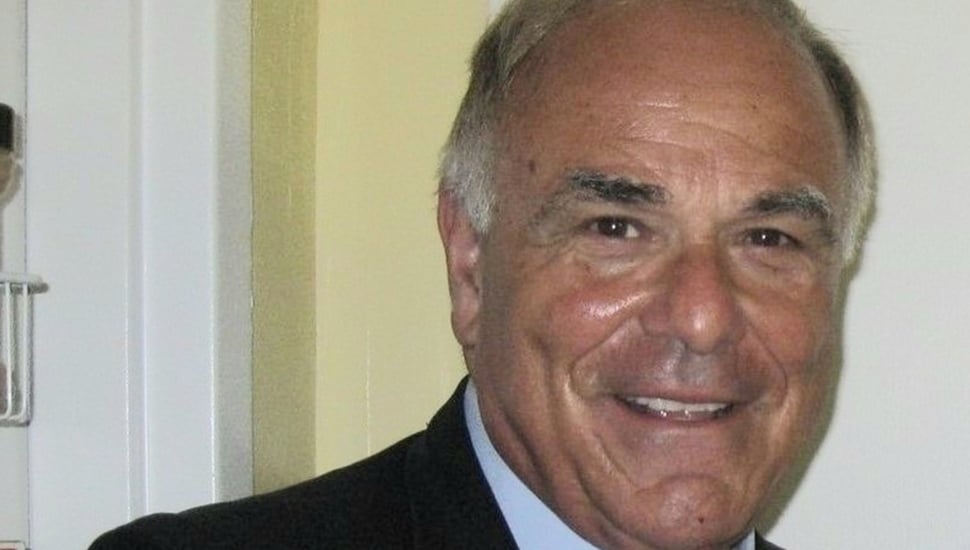

Edward G. Rendell served as the 45th Governor of Pennsylvania from 2003 to 2011.

Join Our Community

Never miss a Delaware County story!

"*" indicates required fields

![95000-1023_ACJ_BannerAd[1]](https://delco.today/wp-content/uploads/sites/3/2023/03/95000-1023_ACJ_BannerAd1.jpg)