Springfield Mall Owner Sees Strong Sales and Mall Occupancy, But a Large Debt

PREIT CEO Joseph F Coradino reports the firm is seeing high mall occupancy, strong sales, and foot traffic closer to 2019, levels,

Even so, PREIT, owner of the Springfield Mall, and the largest mall owner in Pennsylvania. is doing everything it can to reduce a nearly $1 billion debt load coming due at the end of 2023, writes Jake Blumgart for The Philadelphia Inquirer.

The Pennsylvania Real Estate Investment Trust has been selling off weaker-performing malls and diversifying locations weak in retail sales with more medical, residential, and experiential entertainment options.

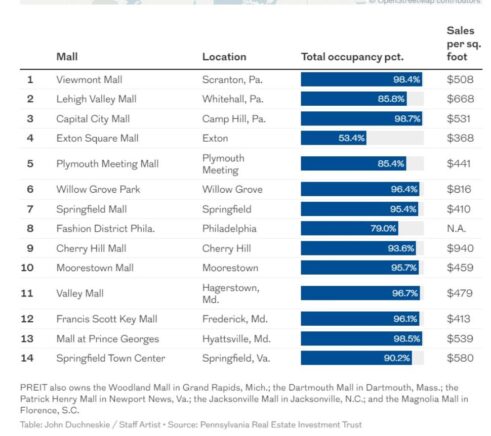

A PREIT chart ranking its mall properties by occupancy and sales per square foot shows the Springfield Mall with a 95.4 percent occupancy, with sales at $410 per square foot.

Its best property in the region, the Cherry Hill Mall, is 93.6 percent occupied, with $940 in sales per square foot.

Its worst-performing property in the region, Exton Square Mall, is 53.4 percent occupied, with sales at $368 per square foot.

PREIT employs more than 25,000 people and runs over 4 million square feet of space in the Greater Philadelphia market.

“Our objective is to continue operating successful properties, increase their value over time, and maximize the value in whatever direction we choose,” Coradino.said.

Read more about PREIT in The Philadelphia Inquirer.

Joe Coradino talks about the state of commercial real estate at Yahoo Finance.

Join Our Community

Never miss a Delaware County story!

"*" indicates required fields

![95000-1023_ACJ_BannerAd[1]](https://delco.today/wp-content/uploads/sites/3/2023/03/95000-1023_ACJ_BannerAd1.jpg)