WSFS Mortgage Study Reveals Positive Attitudes Toward Reverse Mortgages but Also Educational Opportunities

Reverse mortgages are gaining traction as a viable financial strategy for retirees seeking to enhance their cash flow and maintain their lifestyle in their golden years, according to a recent study by WSFS Mortgage, a division of WSFS Bank.

The study, which surveyed 750 homeowners aged 60 and older, sheds light on the potential benefits and the existing knowledge gap surrounding reverse mortgages.

A reverse mortgage is a loan that homeowners, who are at least 62 years old, can take against the equity they’ve built in their home, and it doesn’t have to be repaid until they’ve passed away or left the home. Funds from a reverse mortgage can be provided in lump sums or monthly payments or set up as a line of credit.

“Reverse mortgages have undergone significant changes the past decade, but the biggest change is how many financial advisors are now incorporating housing wealth into their retirement income planning,” said Jeffrey M. Ruben, President of WSFS Mortgage. “A reverse mortgage could be a good option for those seeking to strengthen their cash flow in retirement.”

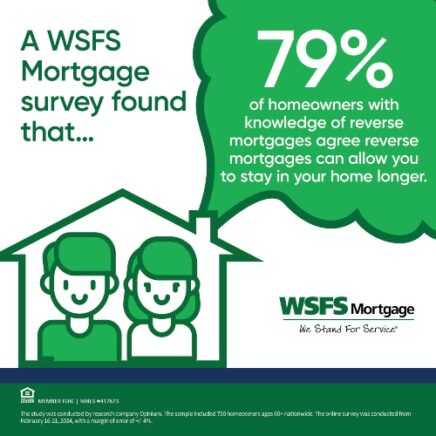

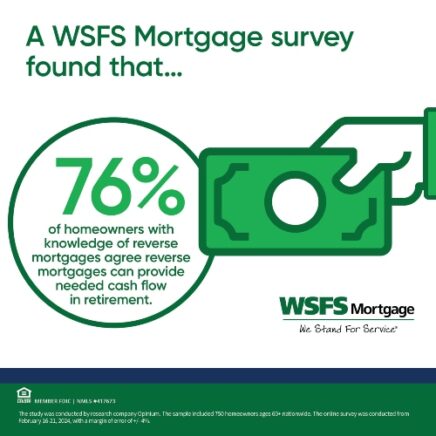

Most homeowners with knowledge of reverse mortgages agree they can allow you to stay in your home longer (79 percent), provide needed cash flow (76 percent) and more financial freedom (62 percent) in retirement, and help cover expenses like long-term care (61 percent).

Despite the benefits of reverse mortgages, the study uncovered a significant lack of knowledge about them. About 31 percent of respondents admitted to having no knowledge of reverse mortgages, while only seven percent considered themselves very knowledgeable. This contrasts sharply with their understanding of other financial products like credit cards and traditional mortgages, indicating a substantial opportunity for education in this area.

“It is not surprising that most Americans do not have a great understanding of a reverse mortgage as it is mostly a strategy that is not available for younger Americans,” said Jamie P. Hopkins, Senior Vice President and Director of Private Wealth Management at Bryn Mawr Trust, a WSFS Bank company. “So, while we get hands-on experience with other borrowing techniques like student loans, credit cards, and traditional mortgages as we move through life, we don’t get the same hands-on experience with reverse mortgages. As such, the need for more education around the product and strategies are arguably more important for Americans.”

Ruben — who joined WSFS Mortgage in 2013 and has helped it achieve year-over-year growth by serving a wide range of clientele, from first-time homebuyers to self-employed individuals to high-net- worth clients — has a list of recommendations for people considering a reverse mortgage:

- Start with the Basics: A reverse mortgage becomes repayable once the home is no longer the primary residence of the borrowers. To qualify, at least one homeowner must be 62 or older and live in the home as their main residence.

- Explore the Benefits: Homeowners can use a reverse mortgage to tap into their home equity. This can help eliminate monthly mortgage payments, provide additional cash flow without dipping into other retirement funds, clear existing debts, and more.

- Consider Downsizing: If you’re thinking about moving to a smaller home, a reverse mortgage could be a strategic move. By selling your current home and combining those proceeds with a reverse mortgage on the new property, you can make the purchase without the burden of monthly payments.

- Consult with Experts: Engage with a financial advisor and lender to clear up any questions or concerns about reverse mortgages, which are often misunderstood as a last-ditch effort. They can assess whether it’s a suitable option for you and help you understand the advantages and disadvantages.

Hopkins — who’s also a bestselling author, educator, and executive speaker — said that, for many Americans, their house is their largest asset but also their largest liability. The costs associated with home ownership — mortgage payments, utilities, property taxes, etc. — are manifold.

“You can use your home very strategically in retirement,” said Hopkins, the author of Find Your Freedom: Financial Planning for a Life on Purpose and Rewirement: Rewiring The Way You Think About Retirement! ”Cash flow from a reverse mortgage can be an alternative source to a traditional investment portfolio. It can help cover things like long-term care, provide retirement income, cash flow management, and tax planning benefits. A reverse mortgage isn’t earned income, so it is not taxable, but you will need to stay current on your property taxes and insurance. It is vital to work closely with your financial advisor to determine if a reverse mortgage is a fit for you.”

Check out more of the study’s findings at WSFS Bank. Learn more about how a reverse mortgage from WSFS Bank can be a key component of a well-balanced retirement plan.

Join Our Community

Never miss a Delaware County story!

"*" indicates required fields

![95000-1023_ACJ_BannerAd[1]](https://delco.today/wp-content/uploads/sites/3/2023/03/95000-1023_ACJ_BannerAd1.jpg)