Study Asks: In Philly, Better to Rent and Invest, or Buy a Home?

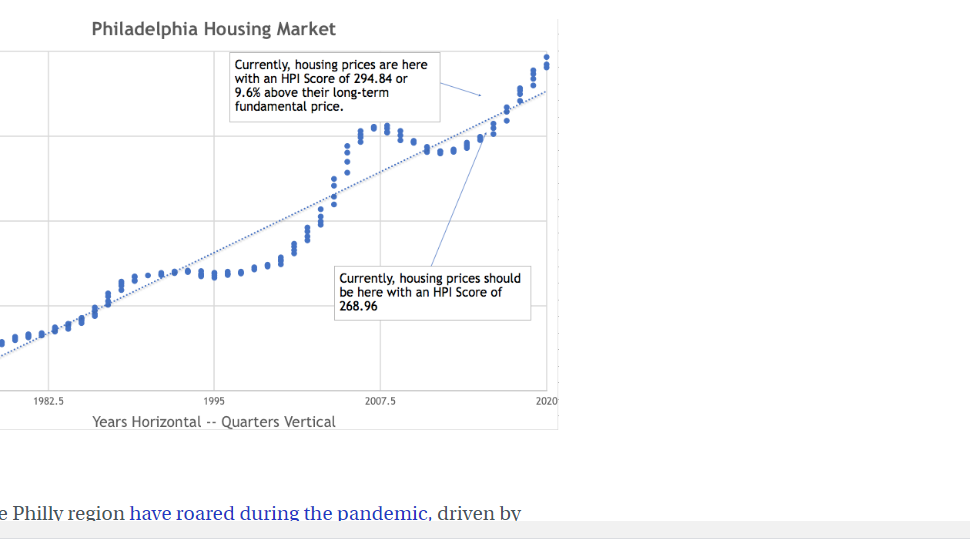

With housing prices about 10 percent higher than usual in the Philly Metro Area, disciplined local investors might want to bypass a home buy and think about the stock market, writes Miles Bryan for WHYY.org.

A Florida Atlantic University Real Estate Initiative study found that Philadelphia-area residents will see a bigger windfall buying stocks and bonds than buying and maintaining a home.

“About 55% of all folks who would rent and reinvest will outperform those who bought at this time [in the Philly metro],” said Ken H. Johnson, real estate economics professor at Florida Atlantic.

But that decision is conditional.

“They would [have to] reinvest everything they would otherwise put into homeownership… maintenance, property taxes, insurance, homeowners association fees,” Johnson said. “In some ways, this is atypical, because most people just do not save every single penny every month and put it back into some form of investment.”

Ultra-low interest rates, a housing stock shortage, and a desire for homes with more space are driving the higher housing prices.

At the same time, Wall Street has hit record highs in recent months and the cost of renting in Philadelphia has remained relatively low, according to the study.

Read more about investments in the Philly Metro Area at WHYY.org.

Join Our Community

Never miss a Delaware County story!

"*" indicates required fields

![95000-1023_ACJ_BannerAd[1]](https://delco.today/wp-content/uploads/sites/3/2023/03/95000-1023_ACJ_BannerAd1.jpg)