Smaller Asset Managers Get Crazy and Creative to Stay Competitive With the Big Boys

Smaller asset managers like Alpha Architect in Broomall are getting creative as they find ways to compete with the bigger, main stream companies like BlackRock, Vanguard and State Street Corp., writes Claire Ballentine for finance.yahoo.com.

Alpha Architect manages about $420 million in assets, and is no stranger to Twitter, blog posts and podcasts to help stay competitive.

“When we write a post, that’s really the lifeblood of what we do,” said Wes Gray, the Delco firm’s founder. “We use Twitter as a way to interact with people.”

Gray has more than 30,000 followers on Twitter.

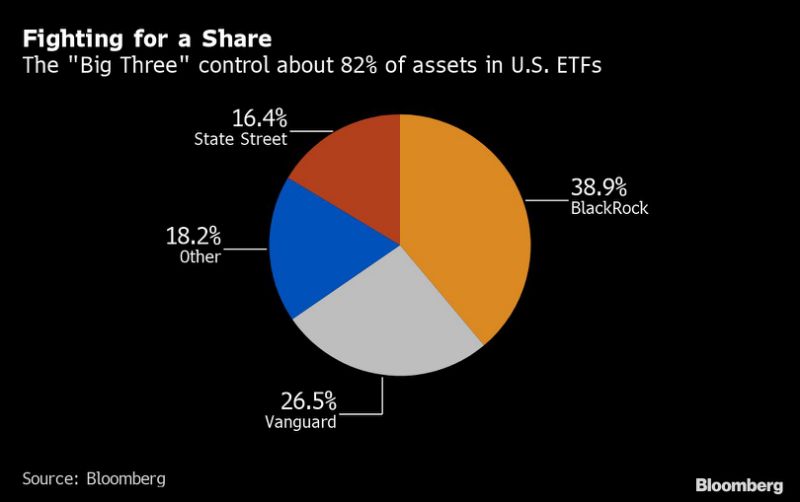

It’s a tough landscape. The Big Three companies account for 82 percent of assets in U.S. ETFs.

Many smaller issuers hope to stand out with niche investments such as cannabis, social media, video games or robotics. Sometimes that means getting wacky to make a splash.

It can mean oddball celebrities, charity giveaways and even astronaut costumers.

For example, the UFC heavyweight known as boa constrictor is advocating for a cannabis fund run by ETF Managers Group.

Smaller issuers are also leveraging the personalities and knowledge of internal experts to promote their funds.

Read more about how smaller asset managers are competing with the big players here.

[uam_ad id=”62465″]

Join Our Community

Never miss a Delaware County story!

"*" indicates required fields

![95000-1023_ACJ_BannerAd[1]](https://delco.today/wp-content/uploads/sites/3/2023/03/95000-1023_ACJ_BannerAd1.jpg)